Send Money Abroad

- Home

- Send Money Abroad

Fast. Secure. RBI-Authorized

International Money Transfers.

Whether you're sending money for education, medical treatment, emigration, family maintenance, or overseas business payments-Richmen Forex ensures your funds reach safely, quickly, and at the best exchange rates.

Why Send Money Abroad with Richmen Forex?

RBI-Authorized Dealer

Fully compliant and regulated, ensuring 100% legal transactions under FEMA guidelines.

Best Exchange Rates:

Get real-time forex rates with minimal markup. No hidden fees.

Same-Day Transfers:

Quick processing through trusted international channels like SWIFT, Western Union, and MoneyGram.

Expert Guidance:

Our forex advisors help you with documentation, limits, and choosing the best route for your purpose.

Transparent Process:

Every step is explained. You stay informed and in control.

Supported Purposes for International Transfers

Pay university tuition or student living expenses abroad.

Transfer funds to international hospitals or healthcare providers.

Send Money Abroad - Richmen Forex

Support relatives living overseas with regular or one-time payments.

Fund your PR, settlement, or relocation processes.

Pay overseas vendors or receive payments for your services.

Make international hotel, event, or holiday bookings.

FAQ

Tax collected at source.

As of the Union Budget 2025, the Tax Collected at Source (TCS) limit for international remittances under the Liberalized Remittance Scheme (LRS) has been increased from ₹7

lakh to ₹10 lakh per financial year. This means that if your total outward remittances exceed ₹10 lakh in a financial year, TCS will apply on the amount exceeding this threshold.

TCS Rates by Purpose (Effective from October 1, 2023)

Purpose of Remittance TCS Rate (if amount exceeds ₹10 lakh)

- Education (funded by loan from specified

financial institution)=0% - Education (not funded by loan)= 5%

- Medical Treatment =5%

- Other Purposes (e.g., investments, travel) =20%

For remittances up to ₹10 lakh, no TCS is applicable, irrespective of the purpose. For amounts exceeding ₹10 lakh, the applicable TCS rates are as mentioned above. It's important to note that the ₹10 lakh threshold is cumulative across all remittances in a

financial year, not per transaction or per purpose. Therefore, if you make multiple remittances for different purposes, the total amount of all remittances will be considered to determine if the ₹10 lakh threshold is exceeded.

Additionally, international credit card transactions abroad are exempt from TCS, providing some relief for frequent travelers.

If you have already paid TCS on your remittance, you can claim it while filing your income tax return, either as a refund or as a credit against your tax liability.

No we won’t accept the cash for international transfers

Liberalized Remittance Scheme (LRS) – in Indian finance:

A scheme by the Reserve Bank of India (RBI) that allows Indian residents to remit up to USD 250,000 per financial year for permissible transactions like travel, education, investment abroad,

etc.

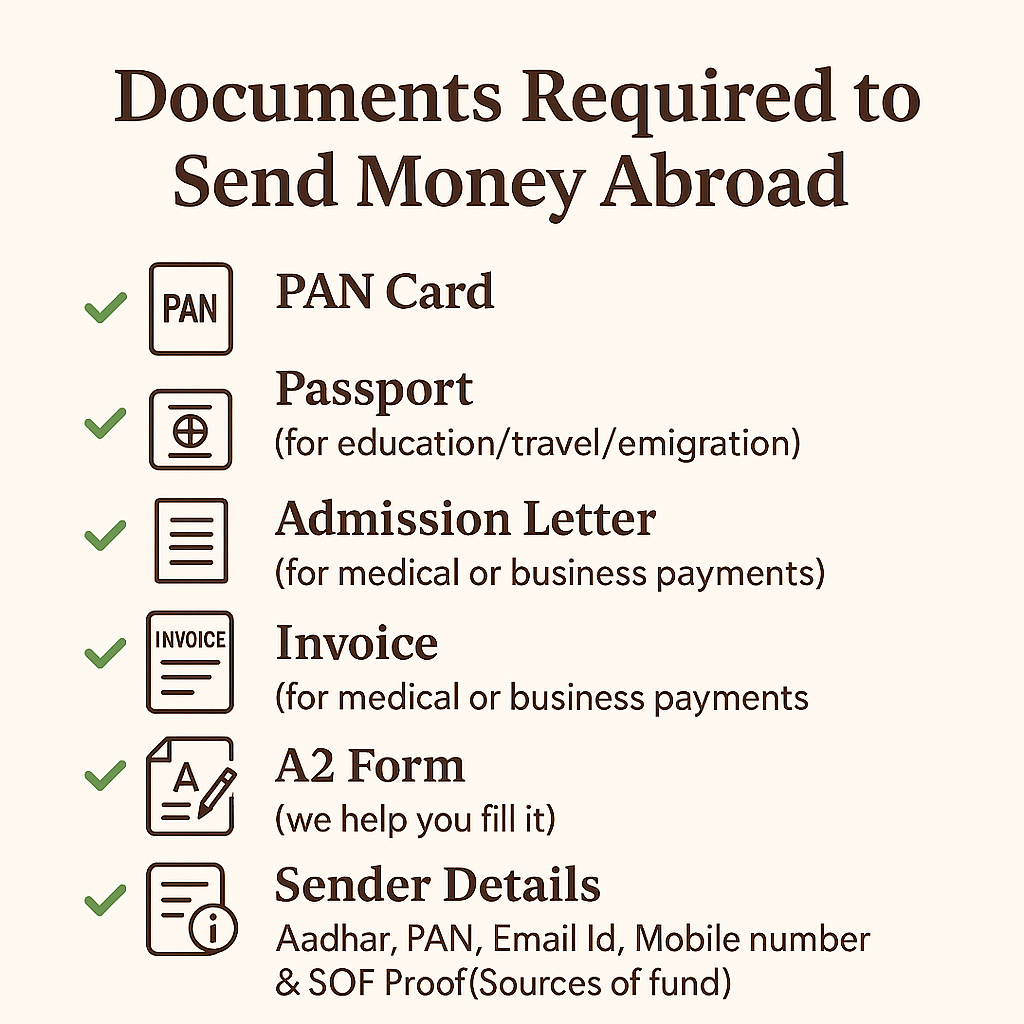

You’ll need a valid passport, PAN card, and purpose-specific documents (e.g., university offer letter for education, invoice for business payment).

Most transactions are processed within 24–48 working hours, depending on the destination country and bank.

As per RBI’s Liberalised Remittance Scheme (LRS), you can remit up to USD 250,000 per financial year for permissible purposes.

Yes, once your transfer is initiated, you will receive a tracking number and status updates.